It said Benjamin Franklin «nothing is certain, except death and taxes «; of the first nothing to add and of the second... this article to confirm that Franklin was absolutely right. We are going to look at some of the taxes that the Romans had to bear in times of the Republic and the Empire. Some examples of indirect taxes (those that we all pay regardless of our economic capacity) will help us to verify that some taxes have accompanied us throughout history, others disappeared because businesses or taxed assets also did so and have even been recovered some that seemed forgotten.

- Portorium . It is the tax that the merchants paid at the entrance of the cities to be able to sell their products. Likewise, it was applied to merchants when they arrived with their merchandise at ports or when crossing certain borders. The amount depended on the type of cargo and the quantity transported. Centuries later, in the kingdoms of Castile and Aragon, this tax was still applied under the name of portazgo .

- Vectigal Rotarium . Vehicle circulation tax -cars-. It is assumed that the use of Roman roads was taxed and the proceeds were used for their conservation -all those that led to Rome-.

- Vicesima Hereditatum . Through the Lex lulia Vicesima Hereditatum , Augustus created this new tax on inheritances. A twentieth of the value of the inheritance had to be paid into the state coffers, discounting funeral expenses, the proceeds of which were used to pay for the retirement of legion veterans. Of course, it had some exceptions:direct relatives (parents, children, siblings...) were exempt from their payment and also, as is the case today, there was an exempt minimum which, in the time of Augustus, was 100,000 sesterces, but only applicable to full-blooded citizens of Rome. The exemptions and the exempt minimum were modified depending on the will of the emperor on duty.

- Vectigal urinae . Urine tax created by Vespasian.

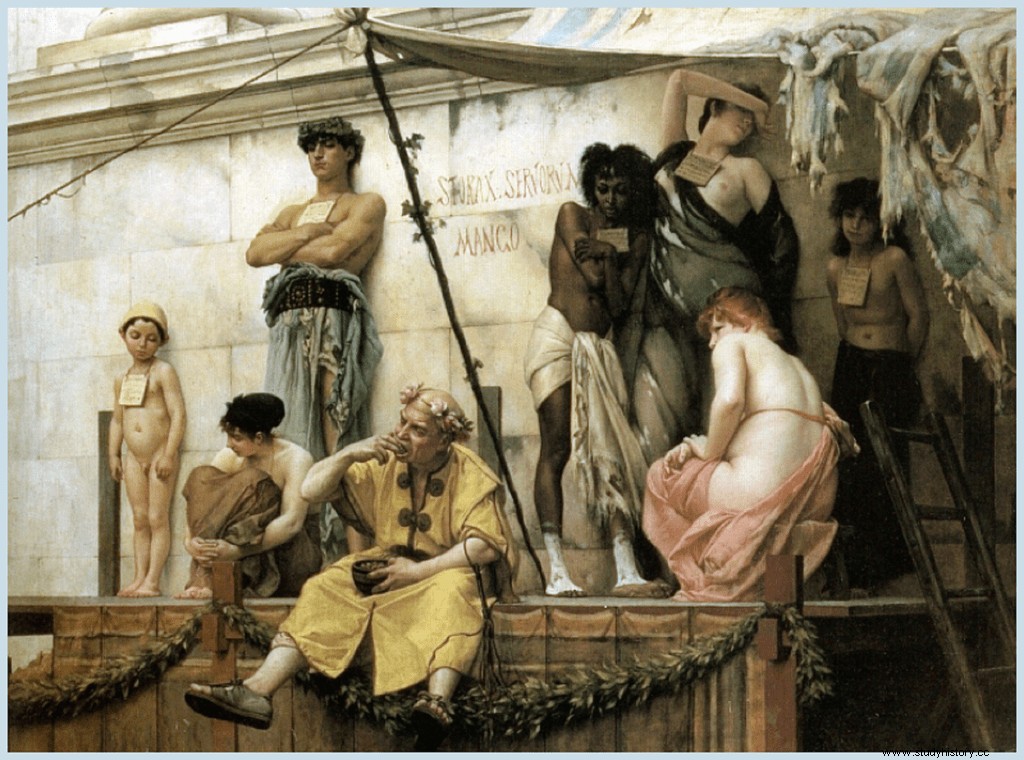

- Centesima rerum venalium orVectigal rerum venalium . Established by Augustus to defray military expenses, one hundredth of the sale price of land, houses, animals had to be paid... If the merchandise was a slave, one twenty-fifth of its value was paid, which the seller had to pay but which he passed on to the buyer (Fifth and vicesima venalium mancipiorum ).

Slave Market (1888) – Gustave Boulanger

- Vicesima Libertatis . This tribute consisted of the payment of one twentieth of the value of the slave when he was released (manumission). It was established in 357 BC. by the consul Manlio Capitolino through the Lex Manlia …

Nothing of note was done by this consul, other than the presentation of a law to the soldiers, in an unprecedented innovation, at the camp of Sutrio, for the tribes to vote on, concerning a tax of five per cent of the manumissions. . The senators, as a similar law provided, when they were of scarce funds, a not inconsiderable income, they ratified it» (Tito Livio).

In addition to earning extra income, Manlius tried to limit the freeing of slaves (called freedmen ) so that the demand for services and land does not increase in Rome.

- Quadragesima Litium . Justice in Rome was neither universal… nor free. The object of litigation was determined and its assessment was carried out (by agreement between the parties or by third party arbitration), as well as the costs of the process itself. The party sentenced by the court had to pay the fortieth part of the valuation of the object of litigation and the costs.

And throwing a bit of imagination, we can establish a correlation between our tax burden and that of Rome:Portorium , tariffs and customs; Vectigal Rotarium , road tax; Vicesima Hereditatum , inheritance tax; Centesima rerum venalium, property transfer tax; Fifth and vicesima venalium mancipiorum, VAT on slavery;Quadragesima Litium, court fees… From the vectigal urinae, It is better not to speak... lest some politician read us.

As a gift I leave you with a very curious one:Aes Uxorium, the single tax. Men who reached a certain age without being married had to pay for it... in addition to having to marry the widows of soldiers killed in combat.

Sources:UNED, University of Salamanca, Fiscal History of Roman Hispania – José M. Piñol